Wizdough Second Entry Strategy

Wizdough Second Entry Strategy for NinjaTrader 8

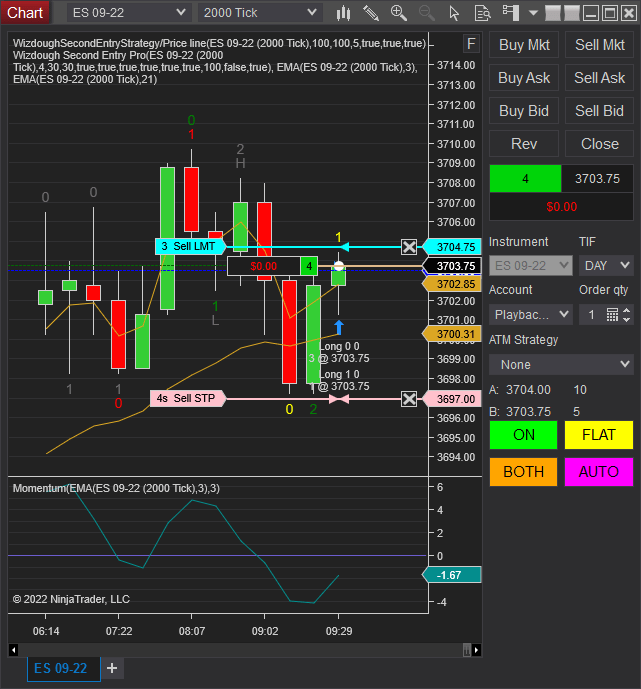

The strategy uses the Wizdough Second Entry Indicator to automatically place orders when the market is in a two-legged pullback status. The strategy also uses EMA to identify the current trend and Momentum to filter out congestions.

- This website is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision.

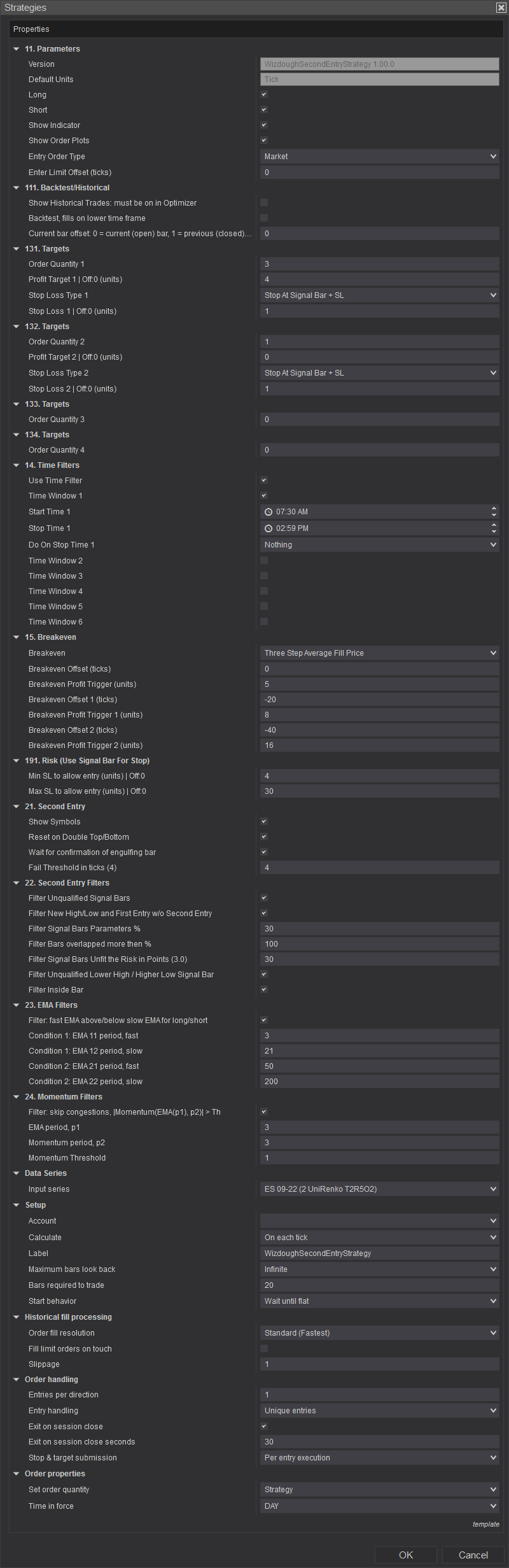

The strategy can be configured in Strategy Properties, as displayed in the picture.

The strategy perchase includes:

- Wizdough Second Entry Indicator

- Technical support Note: We reserve the right to charge hourly for support beyond the initial 1 hour

Features

- Multiple Targets: up to 4

- Order Types: Market, Limit

- Backtesting: Tick replay

- Time Filters: up to 6, action options

- Breakeven: up to 3 levels

- Stop loss at signal bar

- Risk calculation for signal bar stop: min, max

- EMA filters: 2

- Momentum filter

- Supports manual order management

- Control buttons: on/off, flat, long/short, single entry/auto entry

Testing

There are a few options to test this strategy.

Playback Connection. This method allows you to understand how the strategy works in detail. You can watch how it enters and reacts to price change. You can replay the same moment, changing parameters to get the result you want.

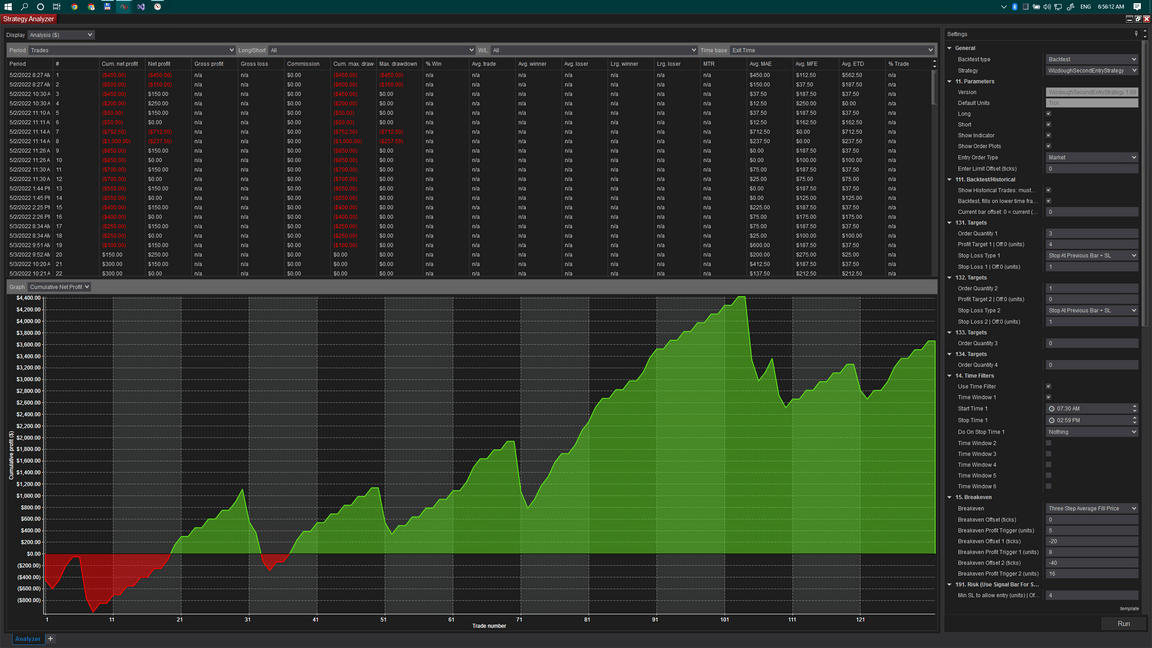

Backtesting with Strategy Analyzer. This method allows you to test the strategy over a more extended time period. You can test the strategy with different parameters, and see the result. The second Entry Strategy uses intra-bar price movements and it requires Tick replay to be enabled. Also, you need to enable “111. Backtesti/Historical -> Backtest, fills on lower timeframe”. Testing speed won’t be high. In my case, one month was tested for 24 hours.

Real-time SIM account. After you tested options 1 and 2 you can try the strategy in real-time. Make sure you use a Simulated Account.

You can see in the picture the result of my testing in SA as an example.

Change Log

01.01.3 2022-10-29

- Performance improved. Now no need to turn off “Show Symbols” for SA backtesting.

- Added selector for two pairs of signals: Plot Long / Plot Short 1, 2

- Added new Trail Type: Previous Bsr + 1 Tick

- Minor bugs fixed.

01.01.0 2022-10-3

- Added Trailing Stops.

- Added PnL limits.

- Modified EMA Cross filter.

- Minor bug fixed.

01.00.0 2022-07-22

- Multiple Targets: up to 4

- Order Types: Market, Limit

- Backtesting: Tick replay

- Time Filters: up to 6, action options

- Breakeven: up to 3 levels

- Stop loss at signal bar

- Risk calculation for signal bar stop: min, max

- EMA filters: 2

- Momentum filter

- Supports manual order management

- Control buttons: on/off, flat, long/short, single entry/auto entry

Feedback

Have you got questions or feedback?

Do you need technology or a new concept for the business?

Contact us and our team will contact you back.