Trade MES closer to ES 2000 ticks

Indicator Overview

If you trade MES you probably wanted your chart to be as close as possible to the ES 2000 ticks chart. Determine the exact value of ticks for MES is a tricky part. MES is not an exact copy of ES and MES 2000 ticks chart will look very different from ES 2000 ticks chart. Some traders choose to trade MES at 955 ticks, others pick 995. Why they choose those numbers and how you can check if it’s the correct number?

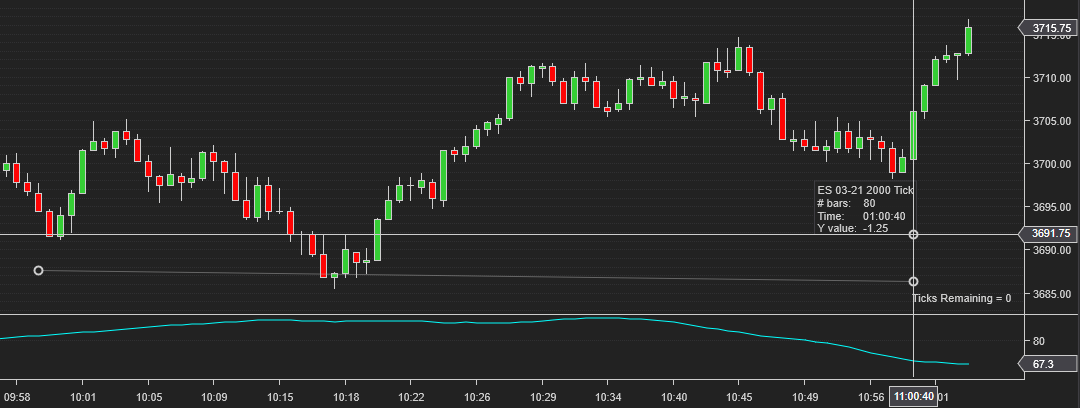

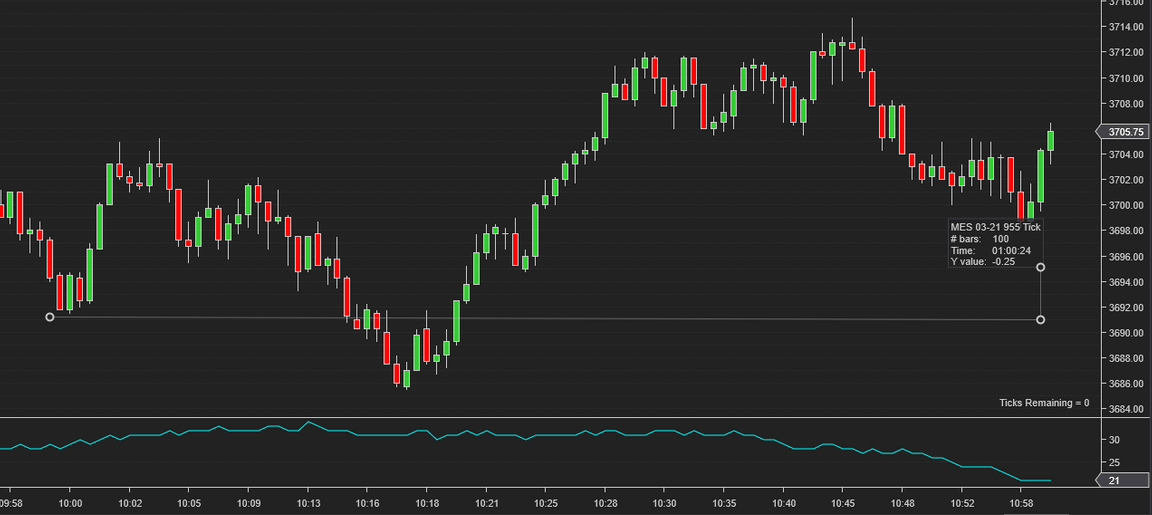

Let’s measure how many bars did RS 2000 generated for the last 60 minutes and let’s find out how many bars we got at MES 955. If those two numbers are about the same then 955 fits well. But sometimes, more often than you think, MES 955 is too far from being a match to ES 2000.

One hour period at ES 2000 has 80 bars.

The same one hour period at MES 955 has 100 bars.

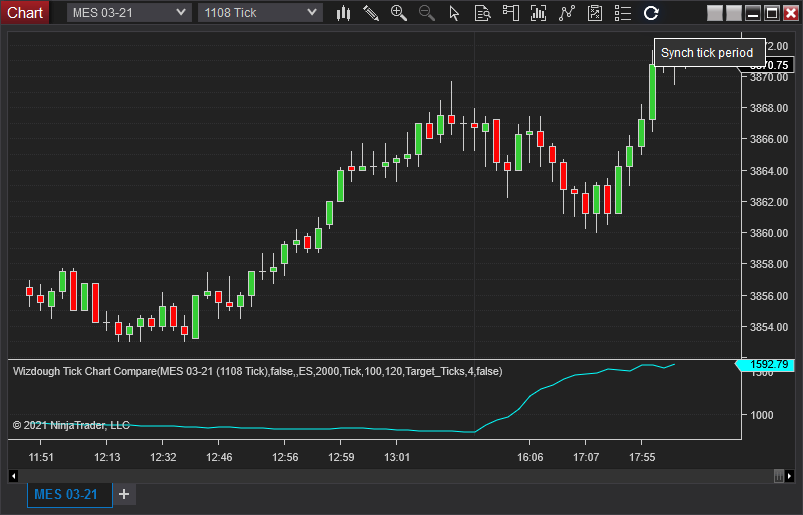

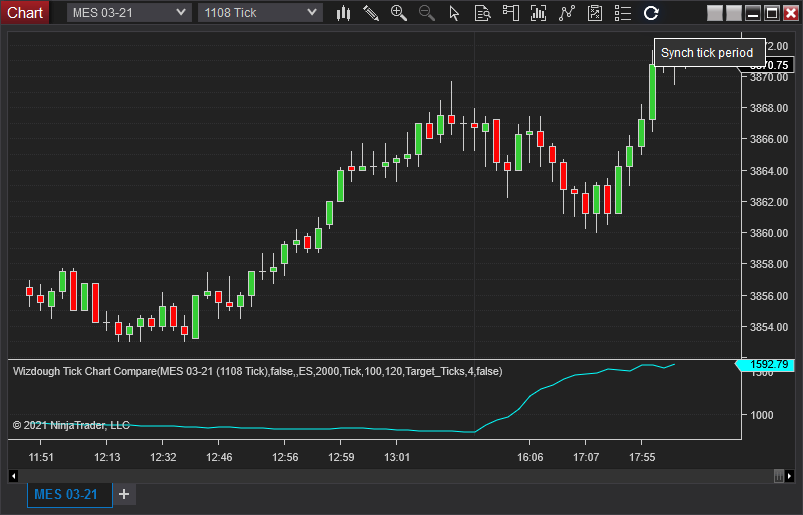

Wizdough Chart Sync Indicator lets you visualize this problem to make adjustments.

Here the indicator calculates a target tick period for MES chart based on a comparison of how many bars do ES and MES tick charts contain for a period of time.

Click the Sync button and the current chart period will change to the one calculated by the indicator.

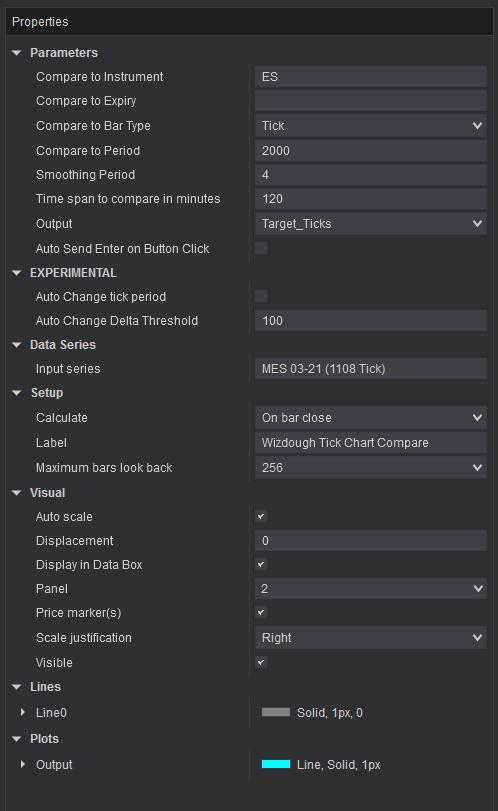

Parameters

Settings.

You can set what instrument you want to compare your current chart. By default, expiry is empty, which means that your current chart’s expiry will be used. It’s possible to compare to charts not only tick-based but also any other types. So, you could compare your MES 1200 ticks with MES 5 min.

The smoothing period helps to avoid unnecessary fluctuations if you want to keep your tick period more or less stable.

Timespan to compare in minutes is a period of time back we use to count bars.

Output can be one of these 3 options:

- Difference_Bars - after counting the number of bars of both charts we get this difference.

- Delta_Ticks - Difference_Bars in ticks. Basically, tells how much we should change the current tick period.

- Target_Ticks - Target_Ticks plus the current tick period. This value should be set as the target tick period.

As described above we can click the refresh button to sync on the calculated tick period. Auto Send Enter - will also press “Enter” to submit the value.

Feedback

Have you got questions or feedback?

Do you need technology or a new concept for the business?

Contact us and our team will contact you back.