Master the Art of Identifying Second Entries

WiSE Indicator for NinjaTrader 8

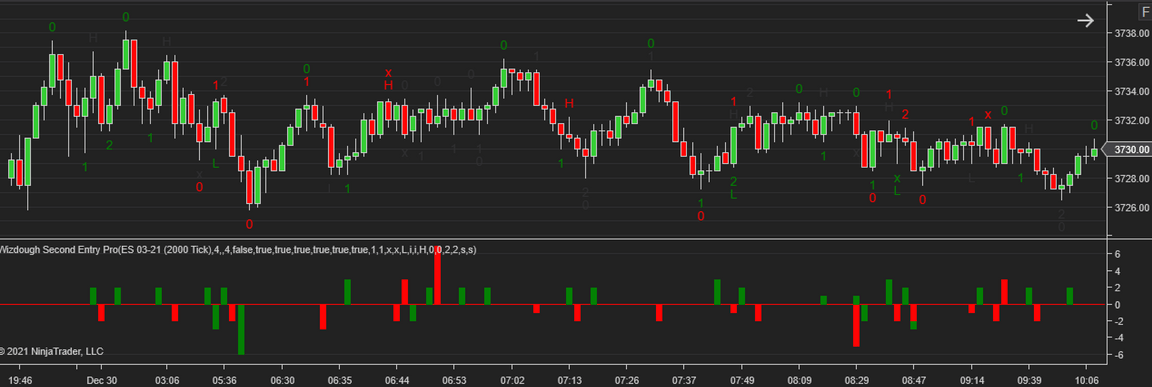

Unlock the power of price action trading with the WiSE (Wizdough Second Entry) Indicator, a groundbreaking tool designed for traders using the NinjaTrader 8 platform. The WiSE Indicator identifies over 16 different price action signals, such as second entries, higher lows, lower highs, and failed second entries, enabling you to spot the perfect entry points for your trades.

Built on Mack’s adaptation of Al Brooks’ original technique, the WiSE Indicator is optimized for any bar type and timeframe, though it particularly excels on ES 2000 ticks charts with a 21-period Exponential Moving Average (EMA).

Manage Your Subscription

By purchasing from this website, you acknowledge that you understand and accept the following agreements:

- No Refunds Policy;

- Terms and Conditions;

- Full Risk Disclosure;

- Software Agreement.

Key Features

- Highly customizable to suit your unique trading style

- Minimalist or comprehensive display options

- Flexible alerts for various trading scenarios

- Variety of filters for ultimate control

- Lightweight and user-friendly for traders of all levels

- Fast performance for real-time analysis and backtesting

- Supports 3rd party strategies

Customize Your Trading Experience

The WiSE Indicator offers an extensive range of settings and filters, allowing you to tailor the tool to your specific needs. Choose from a selection of symbols and colors to represent different signals, and enable or disable alerts as you see fit.

Whether you’re a new trader looking to learn the ropes or a seasoned pro seeking a streamlined experience, the WiSE Indicator can be configured to display as much or as little information as you need.

Harness the Power of Price Action

With its advanced algorithms and innovative features, the WiSE Indicator makes it easy to identify potential entry points based on price action patterns. Spot second entries, lower highs, and higher lows with ease, and make more informed trading decisions in real-time.

The WiSE Indicator is also designed for seamless integration with automated strategies and algo-trading, making it the ultimate tool for today’s modern trader.

Strategy Use

The WiSE Indicator is designed to be used as a standalone tool or in conjunction with other indicators and strategies. It can be used to identify potential entry points, or as a filter to confirm signals from other indicators.

Please watch this video to learn how to use the WiSE Indicator with other strategies:

Get Started Today

Elevate your trading game with the WiSE Indicator for NinjaTrader 8. Discover the difference that expert price action analysis can make, and unlock your full trading potential.

Don’t miss out on this essential tool for successful trading – Get the WiSE Indicator now!

Feedback

Do you have questions or feedback?

Need technology or a new concept for your business?

Contact us, and our team will get back to you.